Validate Vat Registration and Tax Number 1 for EU countries SAP News

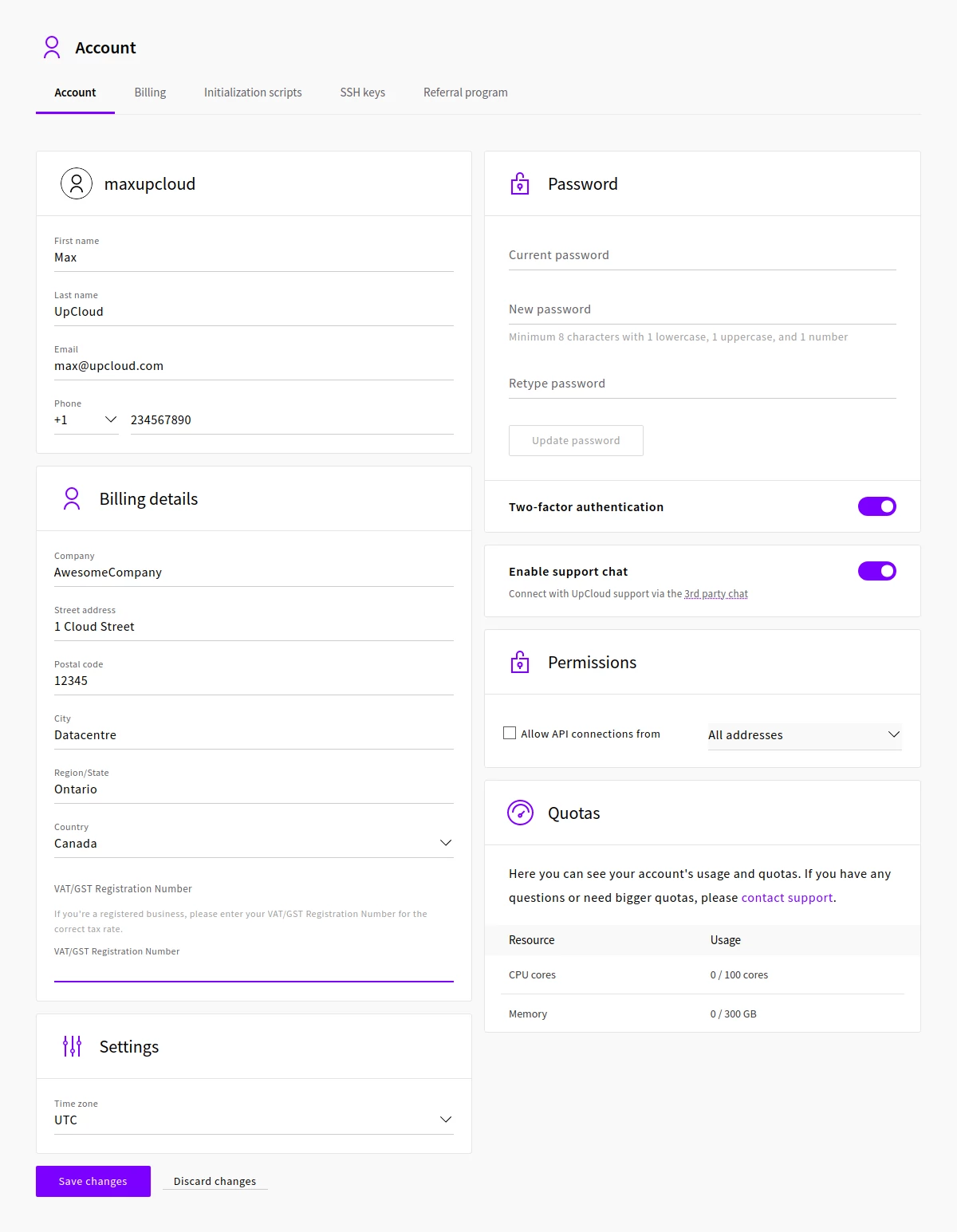

VAT and GST for international businesses UpCloud

What is VIES? VIES (VAT Information Exchange System) is a search engine (not a database) owned by the European Commission. The data is retrieved from national VAT databases when a search is made from the VIES tool.

2016 Form UK HMRC VAT1A Fill Online, Printable, Fillable, Blank pdfFiller

If you are a business owner in the UK, your VAT registration number is a unique identifier that your business receives from the HMRC. The format of the UK VAT number always complies with the following two rules: It contains 9 digits. It starts with the prefix GB. If you work with partners or suppliers in mainland Europe, you may notice that.

How VAT works and is collected (valueadded tax) Novashare

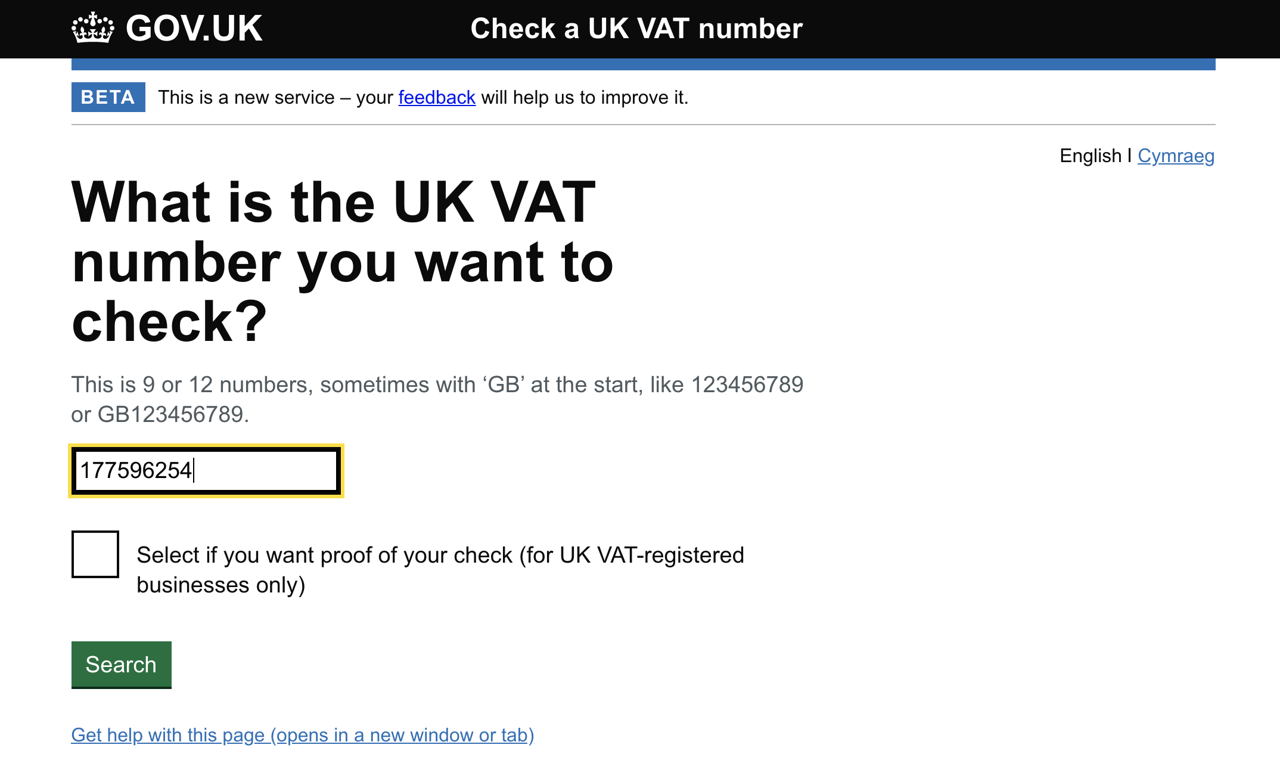

The tax identification number in UK is called VAT number. The format is as follows. VAT number has either 9 or 12 numbers, sometimes with 'GB' at the start, like 123456789 or GB123456789. You can check the validity of UK VAT number from the official HMRC site or a Vat validation provider like Lookuptax. Unique Taxpayer Reference (UTR)

Adding a VAT ID to your account contacts

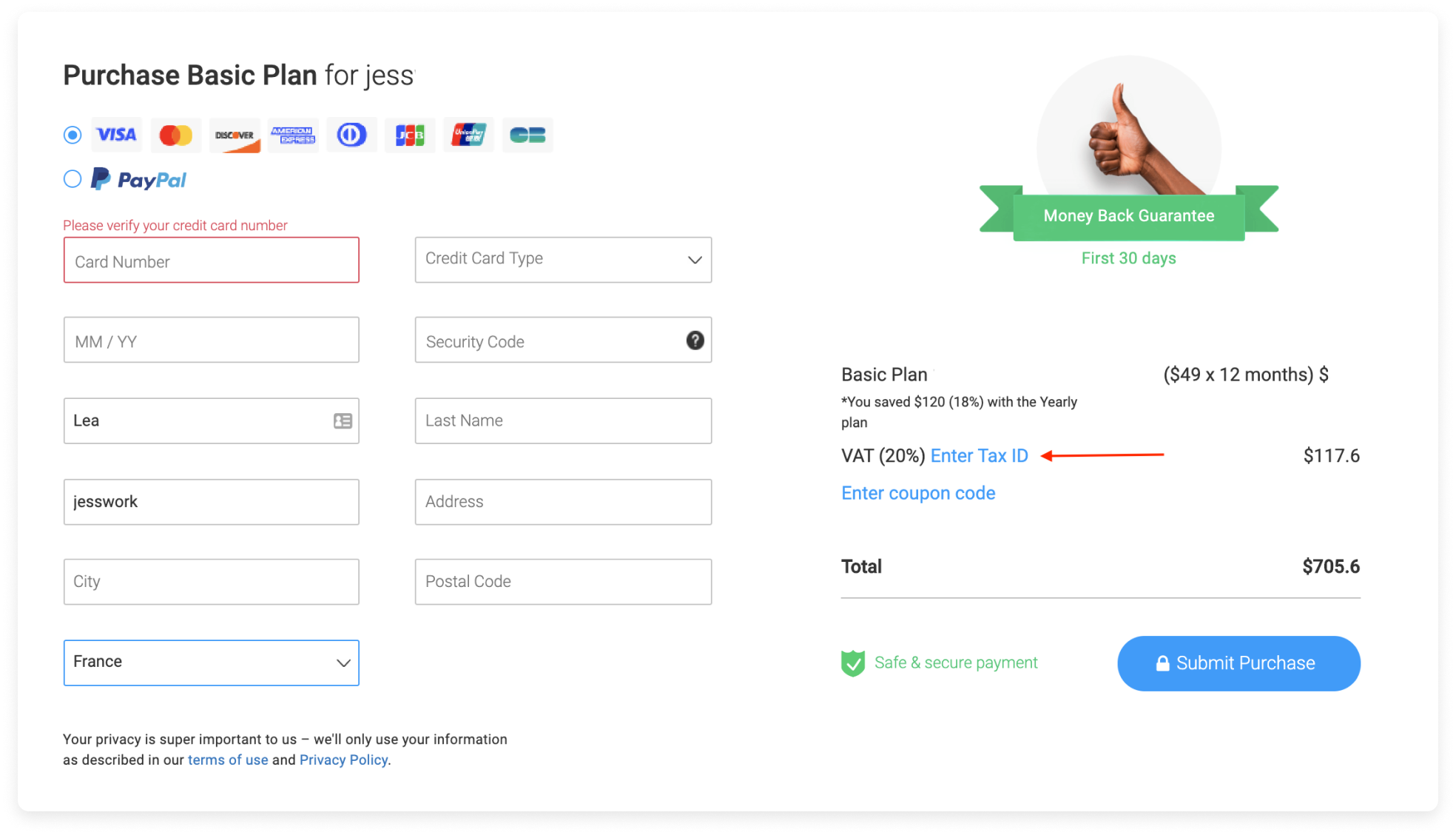

How it works You can ask for the VAT registration number as the main heading or

of the screen. It may be a question or statement. Open this example in a new tab Display in Welsh What is.

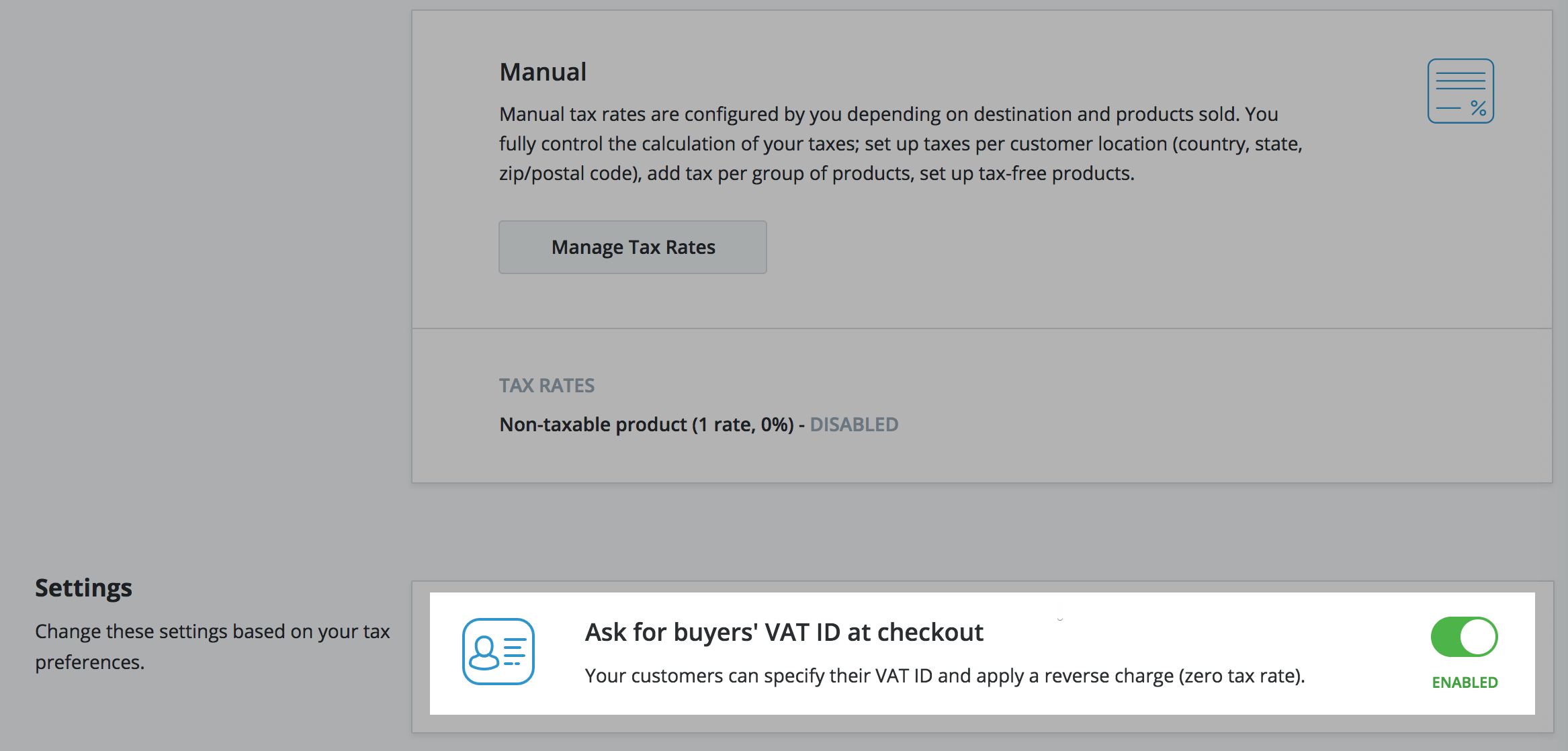

EU taxes (VAT) in Ecwid Ecwid Help Center

A VAT number is a unique ID that HMRC provides to businesses when they register for VAT. In the UK, VAT numbers are nine digits long and always have the prefix 'GB'. If you're dealing with a supplier in another EU country then its VAT number will follow a different format, with its own unique country code..

How to Calculate VAT of UK in Tally 9 and its Accounting Treatment Accounting Education

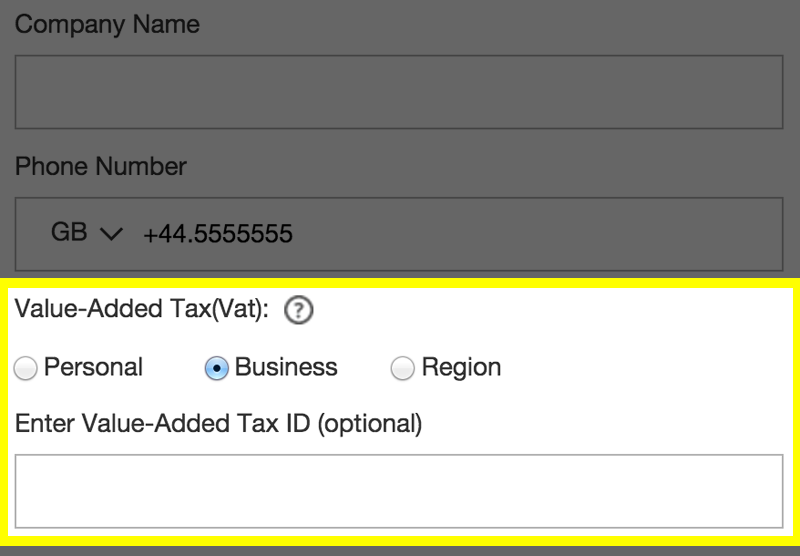

Antonia Klatt Last Updated on 6 September 2023 What is a VAT ID? The VAT Identification number identifies all companies in the European Union and is indispensable for intra-European trade. It can be obtained by registering vor VAT. When trading within the EU (intra-community supply/service) a VAT ID for making sure that taxes are paid is mandatory.

Handling VAT Identification No. and Group VAT ID AppVision Kft.

18 December 2020 — See all updates Get emails about this page Print this page Overview These details will help you to complete an EC Sales List. They include: EU country codes VAT number formats.

VATID Check All important information for EU merchants eClear AG

VAT Number ( VAT) For Entities, VAT, Example: GB723453785. The United Kingdom VAT number can be a 9-digit number, a 12-digit number followed by a 3-digit branch identifier, a 5-digit number for government departments (starting with GD) or a 5-digit number for health authorities (starting with HA). The 9-digit numbers use a weighted checksum.

Handling VAT Identification No. and Group VAT ID AppVision Kft.

UK VAT numbers used to be validated through VIES. After Brexit, HMRC allows you to check and verify the business information of customers in the United Kingdom with their new service.. Check a VAT Identification Number. It's generally advised to check and validate all VAT ID numbers that you encounter in invoices. Even if there is a VAT.

VAT Services Accountancy Services MBL Accounting

The value added tax registration number (abbreviated 'VAT number', or 'VAT reg no.') is the individual identification number of companies that operate internationally within the EU. A VAT number enables international tax authorities to track and tax the transactions of these companies. A VAT identification number is crucial for all.

How to update my VAT ID number? Support

Use this service to check: if a UK VAT registration number is valid the name and address of the business the number is registered to This service is also available in Welsh (Cymraeg). If you.

Add Your VAT ID

A VAT-registered number is a unique identification issued to businesses that are registered to pay VAT.. A UK VAT number is nine (9) digits long, with two letters at the front indicating the country code of the registered business. For example, for Great Britain (UK), the first two digits of the VAT code are GB..

VAT (Value Added Tax) in Nepal Concept, Rules, Filing Returns

Format of VAT numbers Every VAT identification number must begin with the code of the country concerned and followed by a block of digits or characters. Each EU country uses its own format of VAT identification number. Who issues a VAT number

Can I Add My VAT ID on The Invoices?

Below is a summary of the standard formats for each EU country, plus: Norway; Switzerland; and UK. EU VAT number formats Click for free EU VAT number formats i nfo Each EU member country has a slightly different format for their VAT number system, featuring a variation of numbers and letters.

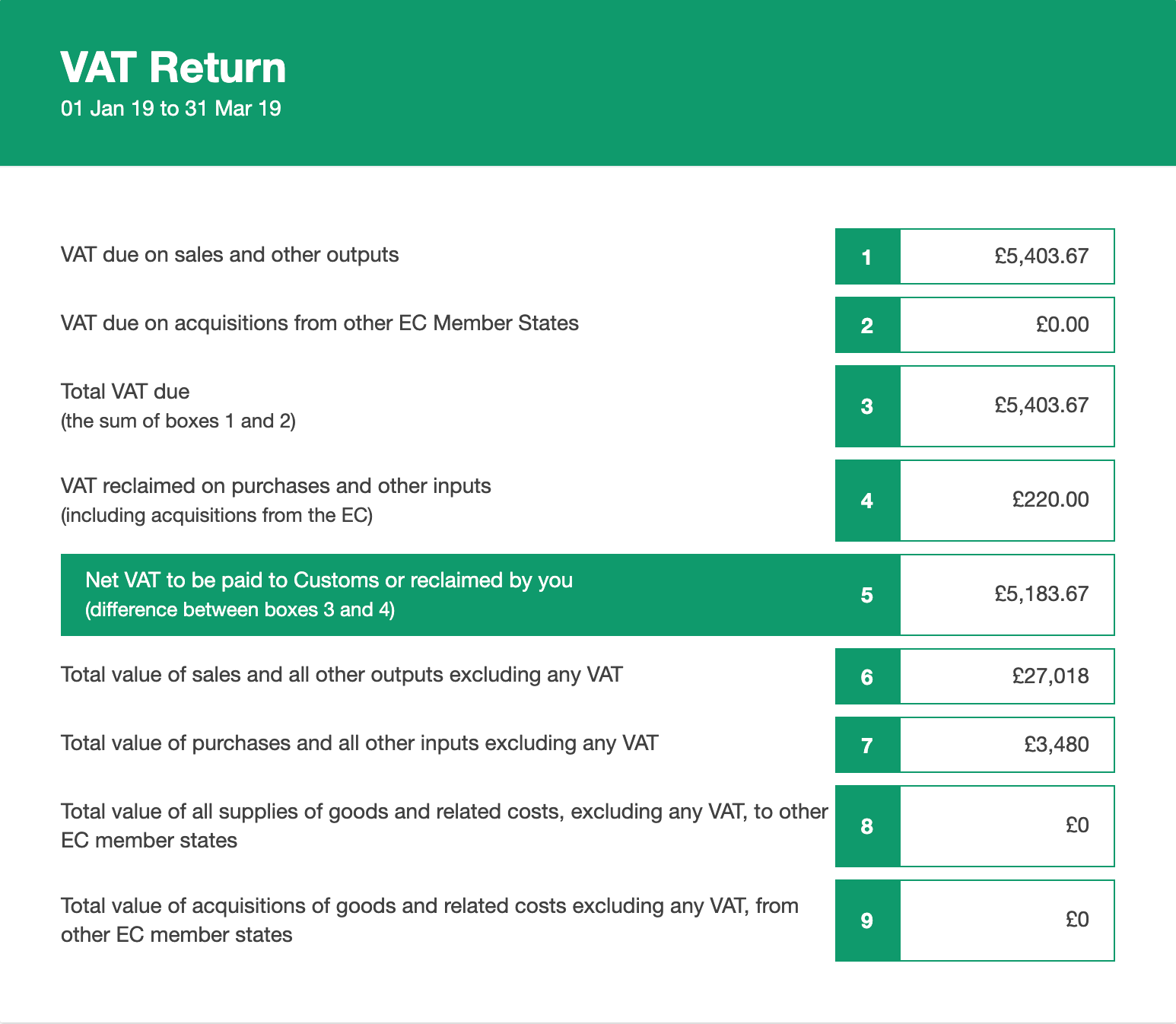

The VAT Flat Rate Scheme (FRS) FreeAgent

The VAT ID enables unique identification of all companies in the European Union. Anyone who wants to trade within Europe must register accordingly for this VAT ID. With the help of this number, your sales and expenses are recorded and thus serve as the basis for corresponding tax payments.

UK VAT Number Validation Vatstack

A value-added tax identification number or VAT identification number ( VATIN [1]) is an identifier used in many countries, including the countries of the European Union, for value-added tax purposes. In the EU, a VAT identification number can be verified online at the EU's official VIES [2] website.