Doji Star Bearish Meaning, Reversal, Trading Formation, Example

Bearish doji star 3D Icon download in PNG, OBJ or Blend format

Doji star bearish candlestick pattern is a trading pattern that is used in technical analysis of stocks for determining the trend reversal stage. This generally happens after a long uptrend has been witnessed in stock price. Let us first try to understand what exactly is the meaning of Doji Star Bearish Candlestick Pattern, how and when is it formed along with the help of an example later.

Bearish Doji Star en candlestick du bør kende

The bearish Doji star pattern suggests that a defined uptrend may be positioned for reversal. It is a bearish reversal pattern that signals a pending downward breakout in price. The three candles of the bearish Doji star are as follows: The first candle is a long, green, or tall white candle.

Bearish Doji Star en candlestick du bør kende

The bearish doji star candlestick is supposed to act as a bearish reversal pattern but doesn't. In fact, it is a wonderful continuation candle because that is what happens to price -- it continues rising 69% of the time, ranking 8th, where 1 is best. Looking at the candle pattern as it moves from a tall white candlestick, to a doji with a gap.

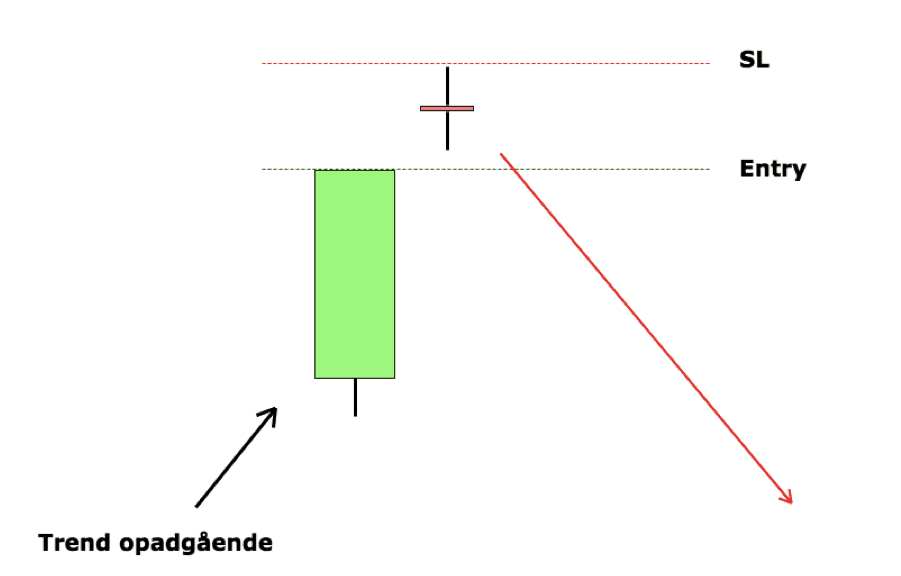

How To Trade The Doji Star

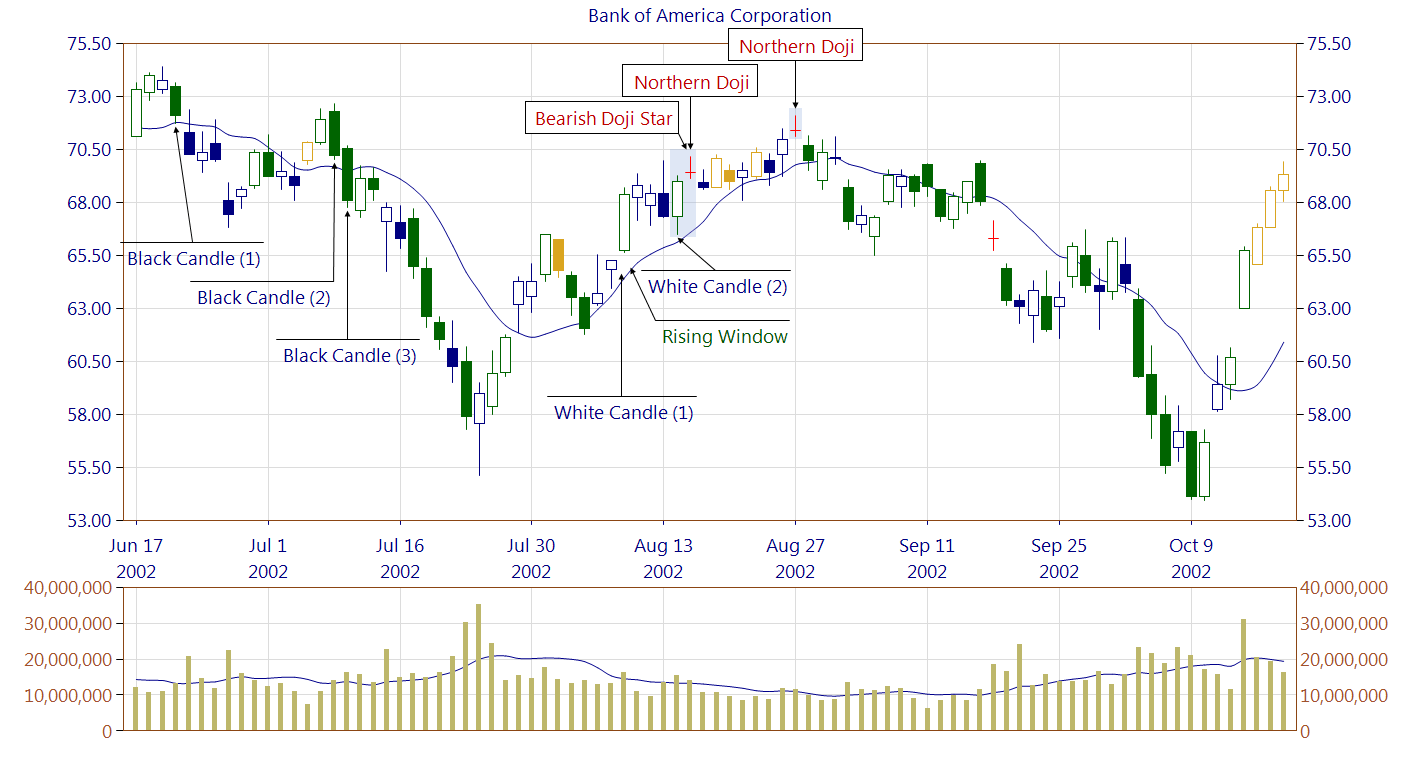

This chapter examines how bearish doji star entails the market trends moving upward, leading to a bullish white candle. It is a candle that closes well above the open, making it a tall, robust one. D.

Bearish Doji Star

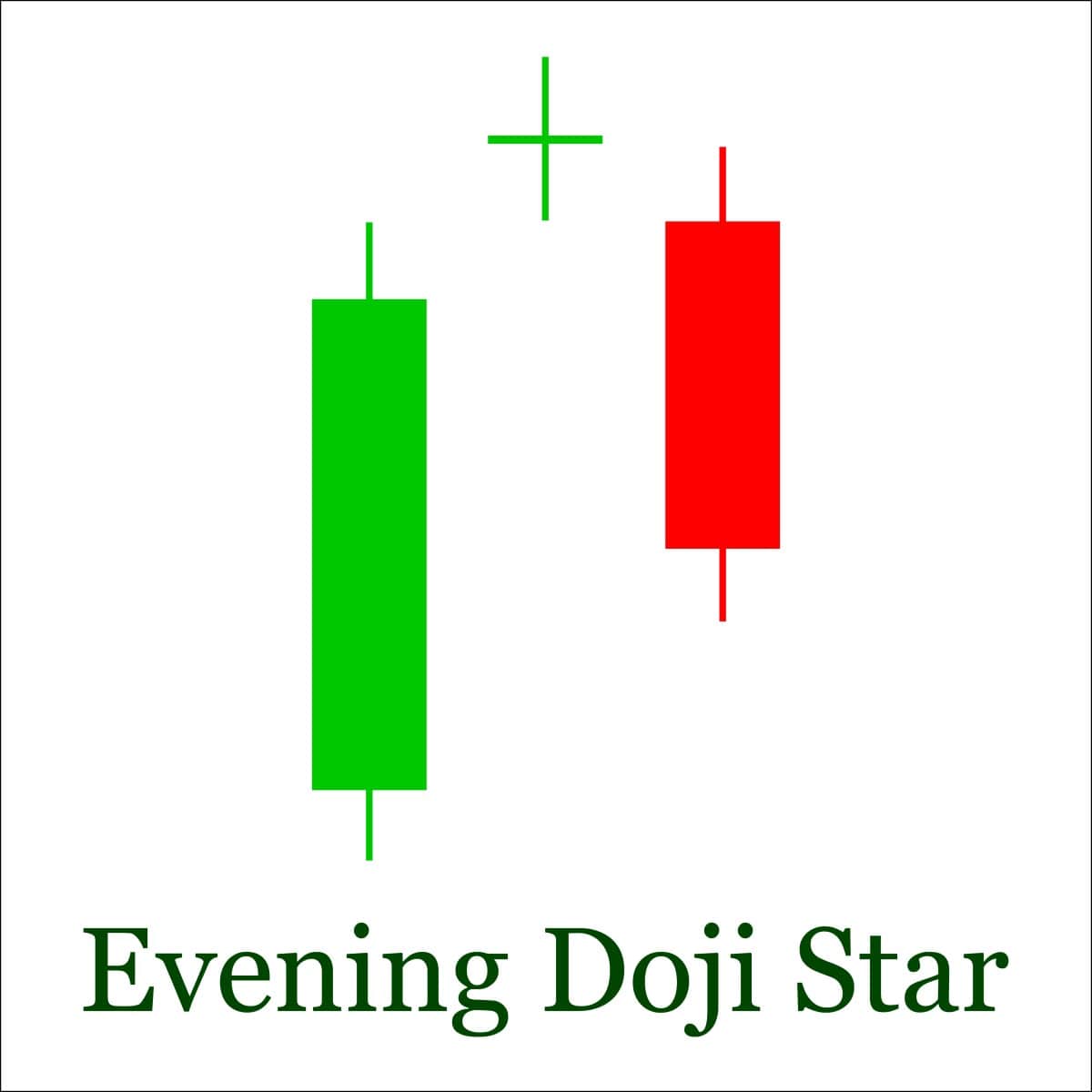

The main difference between the evening doji star and the bearish abandoned baby are the gaps on either side of the doji. The first gap up signals a continuation of the uptrend and confirms strong buying pressure. However, buying pressure subsides after the gap up and the security closes at or near the open, creating a doji.

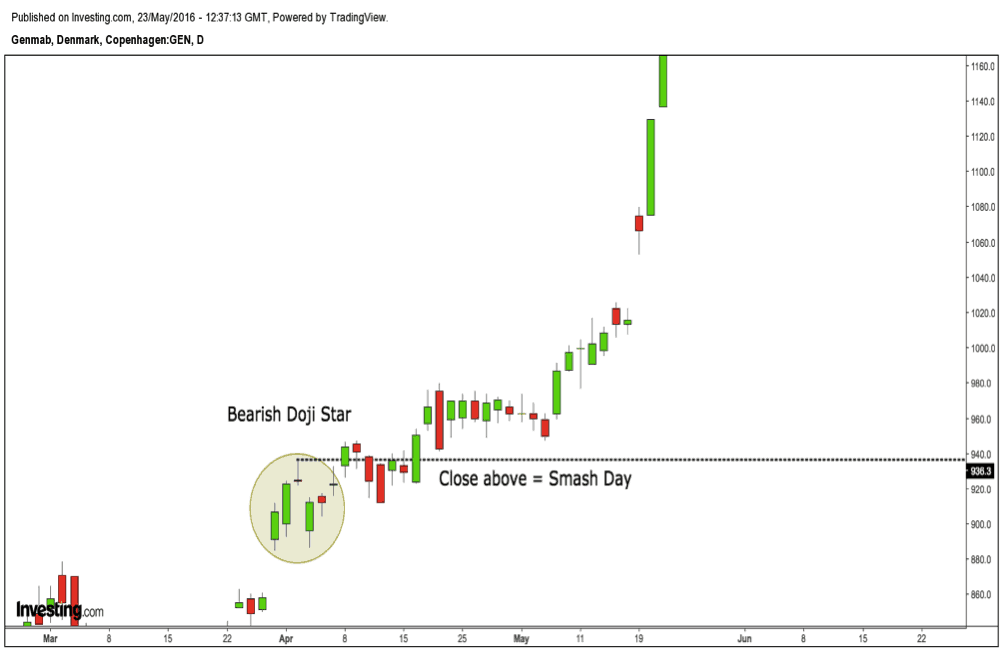

Stock Market Chart Analysis APPLE Bearish Doji Star

The Bearish Doji Star is a bearish reversal pattern represented by two candles. During an uptrend, the first candle is increasing and has a long body. It is followed by a Doji that opens and closes above the previous candle.

Desai18 Evening Star Bearish DOJI » EQSIS PRO

Doji Star - Bearish. This is a bearish reversal candlestick pattern that is found in an uptrend and consists of two candles. First comes a long green candle, followed by a Doji candle (except 4-Price Doji) that opens above the body of the first one, creating a gap. It is considered a reversal signal with confirmation during the next trading day.

Bitcoin Charts Candlestick What Do They Mean Doji Star Bearish Nedir Zulassung Pieske

Bearish Doji Star Bearish Reversal Trade Setup on the Alphabet (GOOG) December 23rd, 2021 daily chart. The bearish doji star candlestick pattern occurs on Google's December 23rd, 2021, daily chart. We see that price is above the 50-day simple moving average, which we're using as a proxy for a bull market or uptrend.

Evening Doji Star Explained & Backtested (2023) Analyzing Alpha

Figure 2. A Bearish Doji Star pattern is formed just below the resistance zones created by the occurrences of Black Candles (numbered from 1 to 3). The second line of the pattern is a Northern Doji pattern. Prior the Bearish Doji Star occurrence, a resistance zone is created by the White Candle (1), Rising Window and White Candle (2) being the first line of the pattern.

Aditya Birla_Evening Star (Or) Bearish Doji » EQSIS PRO

The Bearish Doji Star is a candlestick pattern in technical analysis that suggests a potential reversal of an uptrend. This pattern is formed over two consec.

What is Doji Star Bearish with example in candlestick chart ? YouTube

It is then followed by a gap and a Doji candle and concludes with a downward close. The close would be below the first day's midpoint. It is more bearish than the regular evening star pattern because of the existence of the Doji. The bullish version of the Evening Doji Star pattern is the Morning Doji Star candlestick pattern.

Doji Candlestick Patterns Trendy Stock Charts

Two such candlestick patterns are the bullish and bearish tri-star doji patterns. A tri-star Doji is a three candle reversal pattern that forms at the end of a trend. As its name suggests, it consists of three Dojis which create a triangular pattern after which the market is anticipated to turn in the opposite direction of the main trend.

Doji Star Bearish — TradingView

Bearish Doji Definition: The Bearish Doji Star pattern is a three bar formation that develops after an up leg. The first bar has a long white body while the next bar then opens even higher and closes as a Doji with a small trading range. The final bar then closes below the midpoint of the first day. Practical Use:

Shooting Star Doji Lowest Price, Save 51 jlcatj.gob.mx

Doji candlesticks look like a cross, inverted cross or plus sign. Alone, doji are neutral patterns that are also featured in a number of important patterns . A doji candlestick forms when a.

Doji Patern Mcx Share Candlestick Chart Walt Disney Monde

Bearish star is a bearish trend reversal pattern. Smaller the body of the next session, better it is. If second candle is Doji, it is a stronger formation and known as a Bearish Doji star. This formation needs more confirmation. Price sustaining below the body of the second candle in the subsequent sessions is a bearish sign.

Doji Star Bearish Meaning, Reversal, Trading Formation, Example

In conclusion, the Bearish Doji Star candlestick pattern is a technical indicator used in forex trading to identify potential bearish reversals in the market. The pattern consists of three candles, starting with a long bullish candle, followed by a Doji candle, and ending with a bearish candle that closes below the midpoint of the first candle.