The Dutch VAT (BTW) explained YouTube

Netherlands Corporate Tax Calculator 2022 ODINT Consulting

Dutch VAT rates are based on the European Union's VAT Directive. All EU member states must adhere to the Directive, and the standard VAT rate must be 15% or higher. Rates: 21%, 9% or 0%. In the Netherlands, the standard VAT rate is 21%. There are two additional special rates: the 9% rate and the 0% rate (zero rate).

The Dutch VAT (BTW) explained YouTube

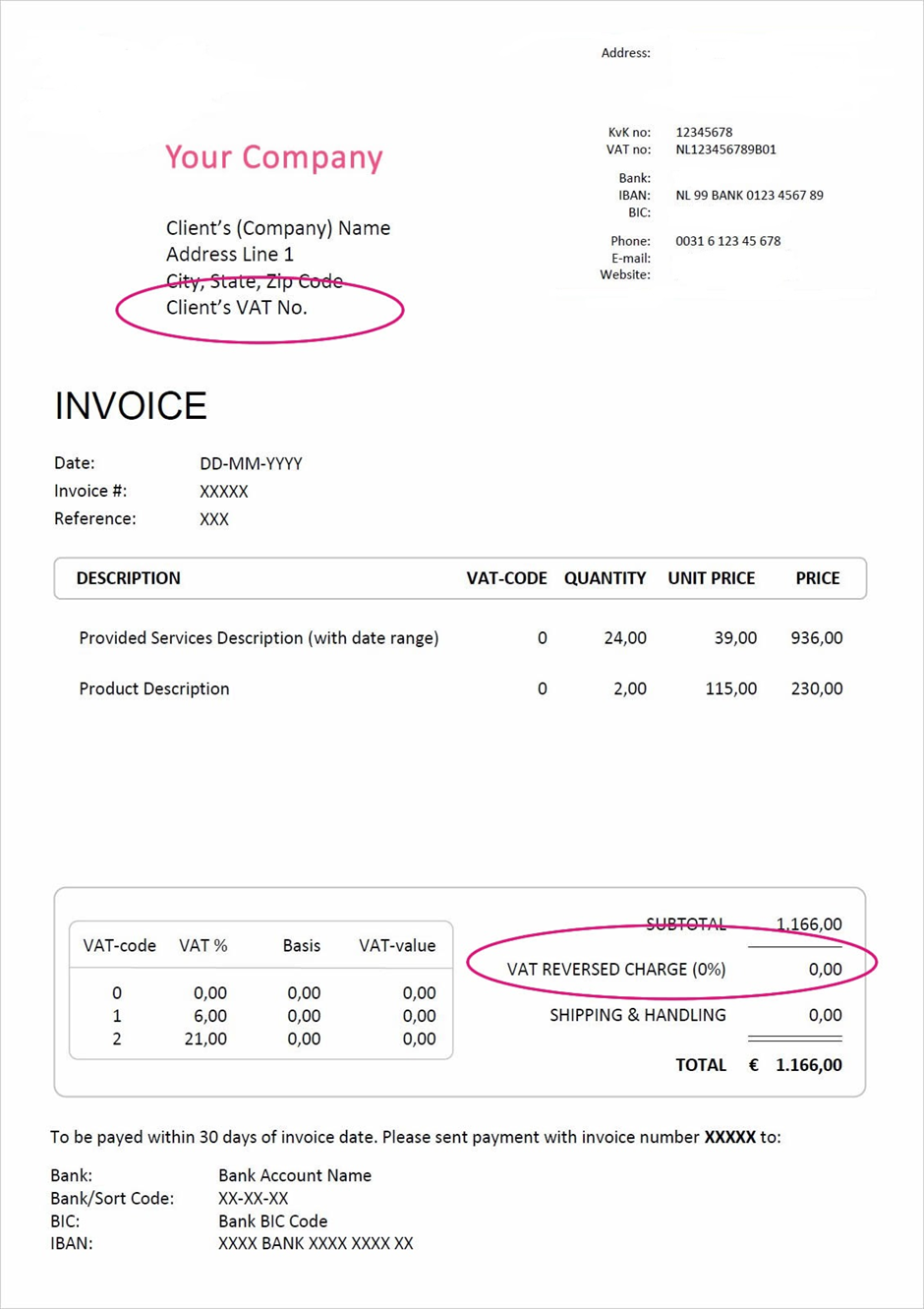

Calculating VAT If you supply goods or services in the Netherlands then you will not always be required to charge VAT. For example, if you are involved with an exemption or the reverse-charge mechanism. This must be shown clearly on the invoice. If you are required to charge VAT, then there are 3 different VAT tariffs. When should you charge VAT?

VAT Registration Netherlands 2023 Guide

Use our instant Netherlands VAT calculator to calculate all your purchases, sales or accounting needs. Our calculator can also be used as a reverse VAT calculator so you can calculate prices excluding VAT. Get started and add or remove VAT now. What Is The Current VAT Rate In Netherlands Amount VAT Rate Adding VAT - VAT Amount

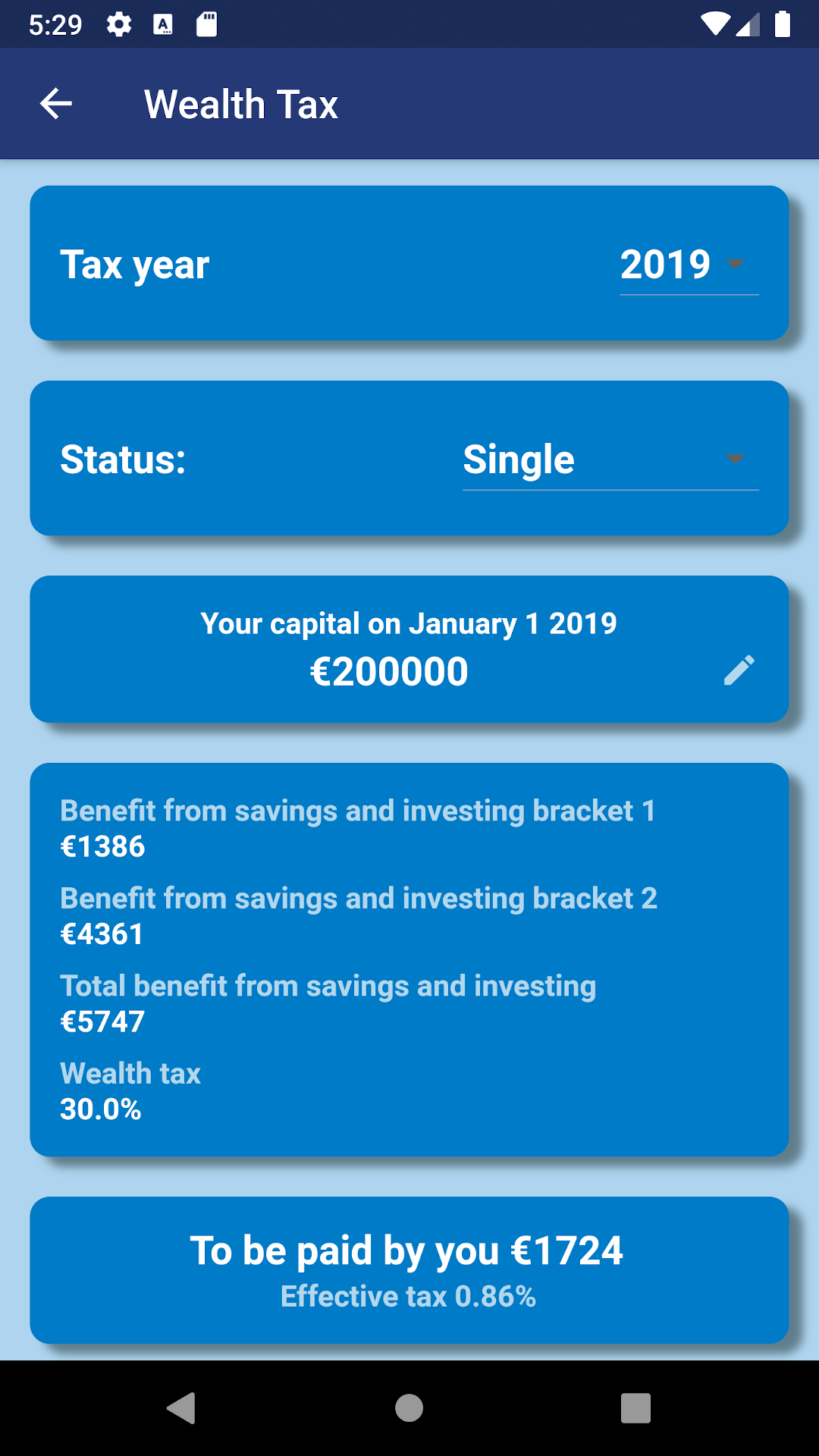

Dutch Tax Check It's All Widgets!

At present, the Netherlands charges Value-Added-Tax (VAT) at a standard rate of 21%. There is also a reduced rate of 9% charged on some products and services, such as imports, supplies, goods and services acquisitions, medicines, foodstuffs, etc. The Netherlands has 3 tariffs: A tariff of 0%, a low tariff of 9%, and a high tariff of 21%.

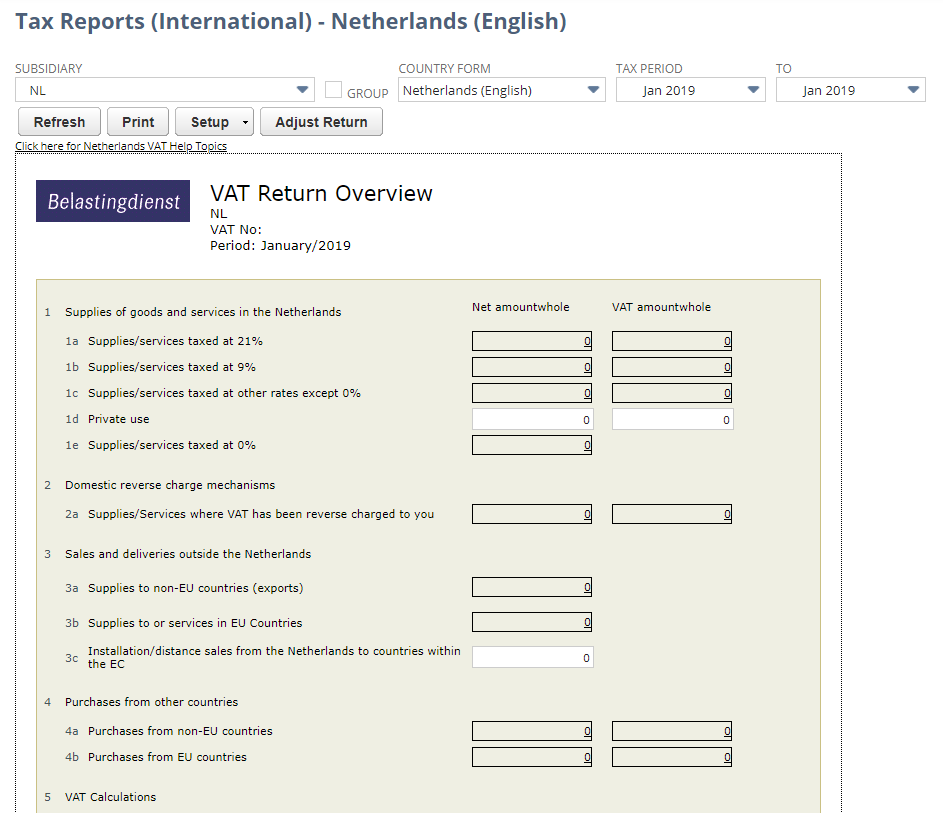

Netherlands Accounting and VAT Reporting

Using our free vat calculator Netherlands, you can calculate the VAT of any product or service. Calculating VAT for multiple products or services can be time-consuming and complex; this calculator helps you save time and simplify the calculation process.

VAT Calculator Netherlands November 2023 VAT Rate is 21

VAT calculator is used to calculating the price of services or goods, including or excluding the VAT price. It helps you determine the amount of VAT with different Vat rates specified to the goods in the market. The VAT calculator allows you to fills in just two fields in the given area of the calculator.

VAT Calculator Freelancer

The Dutch VAT regime ( btw, omzetbelasting) has 3 rates : 0%, 9% and 21%. In some instances businesses are exempt from VAT and in some cases there are special arrangements regarding VAT. VAT rates 0% rate If you are based in the Netherlands and you do business in other countries, the 0% VAT rate may apply.

GitHub Dutch Tax Calculator with AngularJS

Welcome to free online Dutch VAT calculator. It can be used as well as reverse VAT calculator to calculate VAT values in Netherlands. What is VAT rate in Netherlands? Current VAT rate in Netherlands is 21% for most goods and services. There is reduced VAT rate ( 9%) for some goods and services. Value Added Tax in Dutch

Dutch VAT calculator for event services and professionals in the Netherlands

You can calculate VAT in Netherlands by multiplying the product or service price by the appropriate VAT rate. We have included the VAT formula for Netherlands so that you can calculate the VAT manually or update your systems with the relevent VAT rates in Netherlands.

VAT in the Netherlands All VATRelated Information and Services in One Place

Our VAT Calculator & VAT Filer products on a single platform, VAT Calc, are unique in that they come with all of this included out-of-the box for The Netherlands and scores of other countries around the world. Netherlands VAT country guide Netherlands ends Intrastat reporting threshold 2023 Netherlands reluctant on domestic B2B e-invoicing

How to issue Dutch invoice Dutch VAT Invoice Requirements

VAT Calculator Netherlands Also Check Reverse VAT Calculator Netherlands VAT Including Results VAT Excluding Results Result For Including 5% VAT Rate (Optional) Result For Excluding 5% VAT Rate (Optional) Comparision of 20% & 17.5% VAT Rate (Optional) Share This Page: Checkout Our More Pages ⇒ VAT Calculator (All Countries)

VAT in The Netherlands (BTW) Jad Consultancy

Netherlands VAT Calculator | Effortless VAT calculations Fully updated for 2022 Dutch VAT rates. Net Amount (excludes VAT) Gross Amount (includes VAT) Copyright: vatcalculators.online 4. The calculation automatically updates. 5% VAT Calculator 12.5% VAT Calculator 20% VAT Calculator UK VAT articles

NetSuite Applications Suite Netherlands VAT Report

You can calculate VAT in Netherlands by multiplying the product or service price by the appropriate VAT rate. We have included the VAT formula for Netherlands so that you can calculate the VAT manually or update your systems with the relevent VAT rates in Netherlands.

Value added tax

The Dutch VAT is an indirect tax levied through withholding by entrepreneurs who sell goods, deliver services, or import goods into the Netherlands. The VAT due is generally mentioned on the invoice, which functions as the cradle for the levy of VAT in the Netherlands. The VAT rules are harmonized in all European Union member states, based on.

Netherlands Antilles Tax Rates and Thresholds in 2023

Custom Rates VAT Calculator custom % Austria VAT MwSt./USt. Calculator The Austrian VAT rates are 20% 13% 10% in 2023 Belgium VAT BTW/TVA/MWSt Calculator The Belgian VAT rates are 21% 12% 6% in 2023 Bulgaria VAT (ДДC) Calculator The bulgarian VAT rates are 20% 9% in 2023 Croatia VAT (PDV) Calculator The Croatian VAT rates are 25% 13% 5% in 2023

VAT Registration Netherlands 2023 Guide

VAT Rates in the Netherlands. The standard VAT rate in the Netherlands is 21%. But, there are two more rates 9% and 0%. Here, certain goods and services are exempted from VAT and this applies to various business activities, such as education, health care, insurance, banking services, and more. Read more about VAT on the home page. FAQs