Inverse Head and Shoulders Pattern [2022 Update] Daily Price Action

How To Trade Inverse Head And Shoulders Chart Patterns YouTube

How To Identify The Inverse Head And Shoulders Pattern? Price action forms the shape of an upside down head atop two upside down shoulders, with three total troughs. The left shoulder and first trough is formed on high volume. Volume begins to decline with a higher trough forming a head. Finally, a right shoulder of roughly equal depth as the.

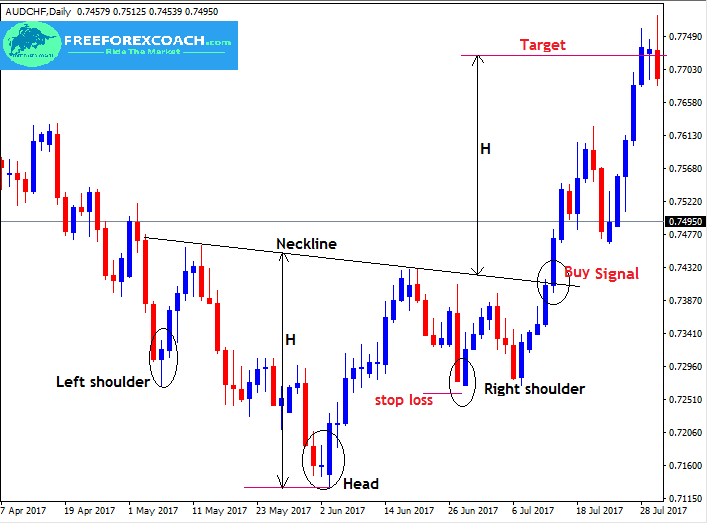

Inverse Head and Shoulders in Forex Identify & Trade Free Forex Coach

Head and Shoulders Pattern vs. Inverted Head and Shoulders. The inverted head and shoulders pattern forms after a downtrend and signals a potential trend reversal to the upside. It contains the same elements as a standard chart head and shoulders but in an upside down formation. Key differences: Standard head and shoulders is bearish, inverted.

Reverse Head And Shoulders Pattern (Updated 2023)

FREE SHARES! Find out how to get FREE SHARES in Aalavon Investments by visiting us at: www.aalavon.comLearn to Day Trade for Free! Watch more free educationa.

Head and Shoulders Pattern Trading Strategy Synapse Trading

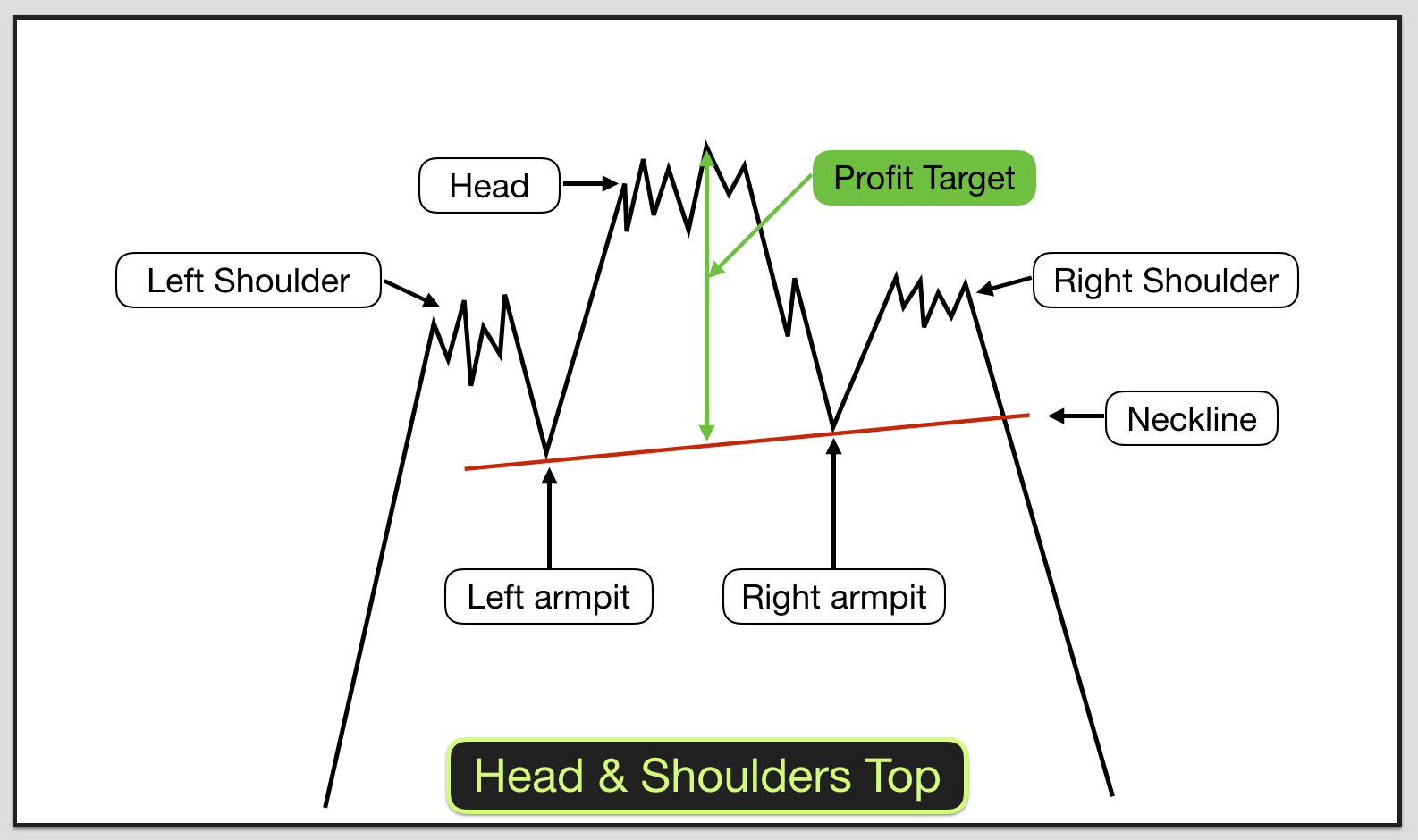

Kiril Nikolaev · October 25, 2023 Trader Survival Guides 10 min read The head and shoulders pattern is a classic technical indicator. It helps traders identify when (not if) an ongoing trend will reverse - if an asset is on a bull run, a head and shoulders points to an imminent bearish breakdown.

Head and Shoulders pattern How To Verify And Trade Efficiently How

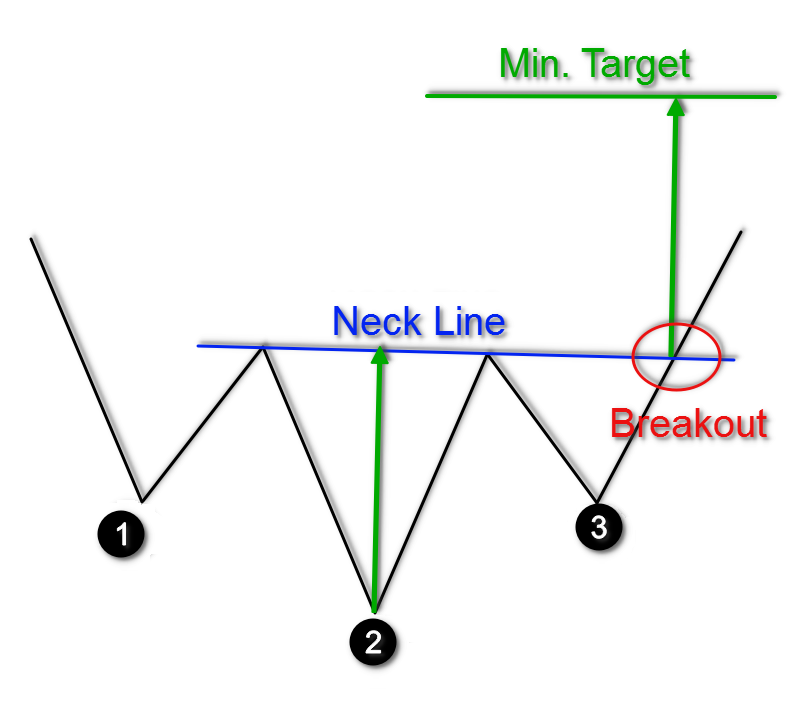

The profit target for the inverse head and shoulders pattern would be: $113.20 (this is the high after the left shoulder) - $101.13 (this is the low of the head) = $12.07. This difference is.

Head and Shoulders Pattern Trading Strategy Guide Pro Trading School

The inverse head and shoulders chart pattern is a bullish chart formation that signals a potential reversal of a downtrend. It is the opposite of the head and shoulders chart pattern, which is.

Inverse Head and Shoulders Pattern [2022 Update] Daily Price Action

The head is the largest of the three peaks. An Inverse Head and Shoulders pattern is when the head and shoulders pattern is upside down and follows similar structure in reverse (see "Turning H&S on its head" below). The Inversion Head and Shoulders is a reversal pattern from an established downtrend. Inverse H&S pattern components

Upside down head and shoulders for FXUSDJPY by philstodd84 — TradingView

The inverse head and shoulders, or inverted H&S pattern, is formed at the end of a downtrend. Is the inverse head and shoulders bullish or bearish? It's a bullish pattern that predicts a reversal from a down to an uptrend. It's the opposite of the head and shoulders setup, which appears at the end of an uptrend and signals a coming price decline.

How To Trade Blog What is Inverse Head and Shoulders Pattern

A head and shoulders pattern has four components: After long bullish trends, the price rises to a peak and subsequently declines to form a trough. The price rises again to form a second high.

Inverse Head and Shoulders Pattern How To Spot It

This classic reversal pattern is a high probability chart formation that predicts a bullish to bearish trend reversal with a big accuracy. The same formation can appear upside down, which we call as an inverse Head and Shoulders. In this last case, the pattern predicts a possible trend change from down to up. Let's look at them more closely.

upside down head and shoulders for FXNZDCAD by Ntuki — TradingView

Also known as the "head and shoulders bottom" formation, the inverse head and shoulders chart pattern can help you time the bottom of a downtrend and buy into an asset at the perfect time. This is part of technical analysis, which relies on studying recent price patterns to predict future market movements.

Inverse Head and Shoulders Pattern Trading Strategy Guide

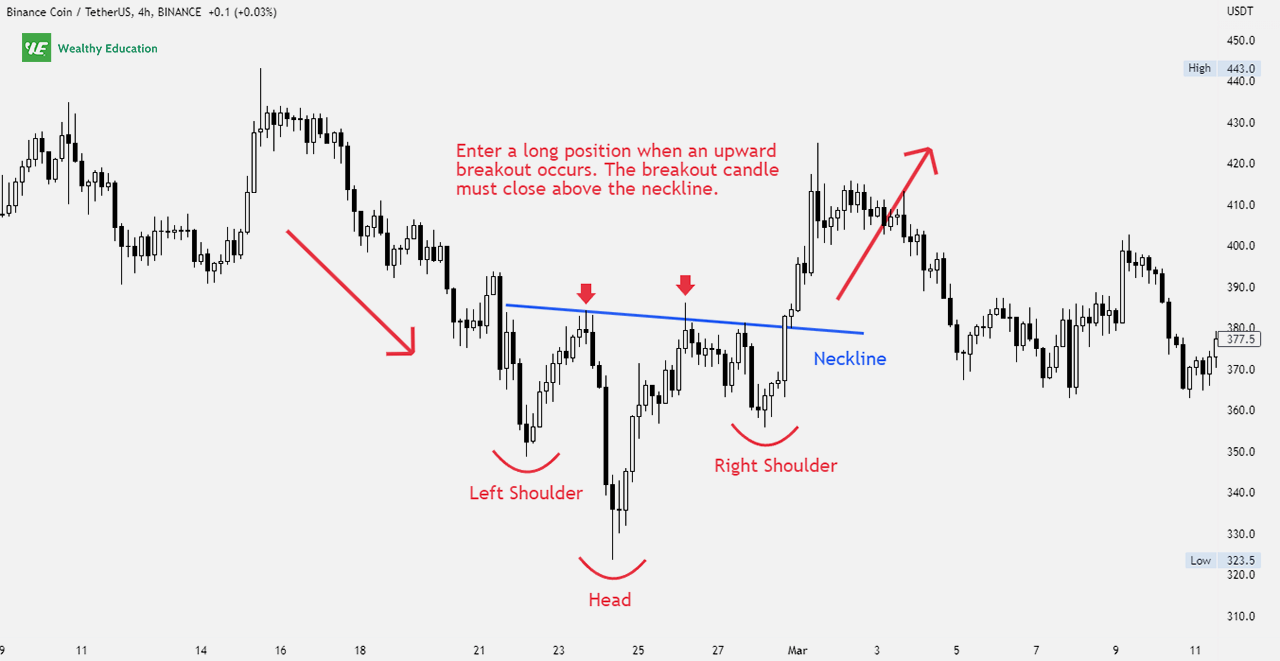

The formation is upside down and the volume pattern is different from a head and shoulder top. Prices move up from first low with increase volume up to a level to complete the left shoulder formation and then fall down to a new low. A recovery move follows that is marked by somewhat more volume than seen before to complete the head formation.

invertedheadandshoulderspattern Forex Training Group

Trading the Inverse Head and Shoulders Pattern - Warrior Trading The Inverse Head and Shoulders Pattern is a fantastic bullish reversal pattern that new traders should add to their list of patterns to learn to trade.

Trading the Inverse Head and Shoulders Pattern Warrior Trading

It is basically a head and shoulders formation, except this time it's upside down . 🙃 A valley is formed (shoulder), followed by an even lower valley (head), and then another higher valley (shoulder). These formations occur after extended downward movements.

Forex Head And Shoulders Pattern Xfx Trading Reviews

The inverse head-and-shoulders pattern is a common downward trend reversal indicator. You can enter a long position when the price moves above the neck, and set a stop-loss at the low point of the right shoulder. The height of the pattern plus the breakout price should be your target price using this indicator.

The Inverse Head & Shoulders Pattern THE MULTIPLIER

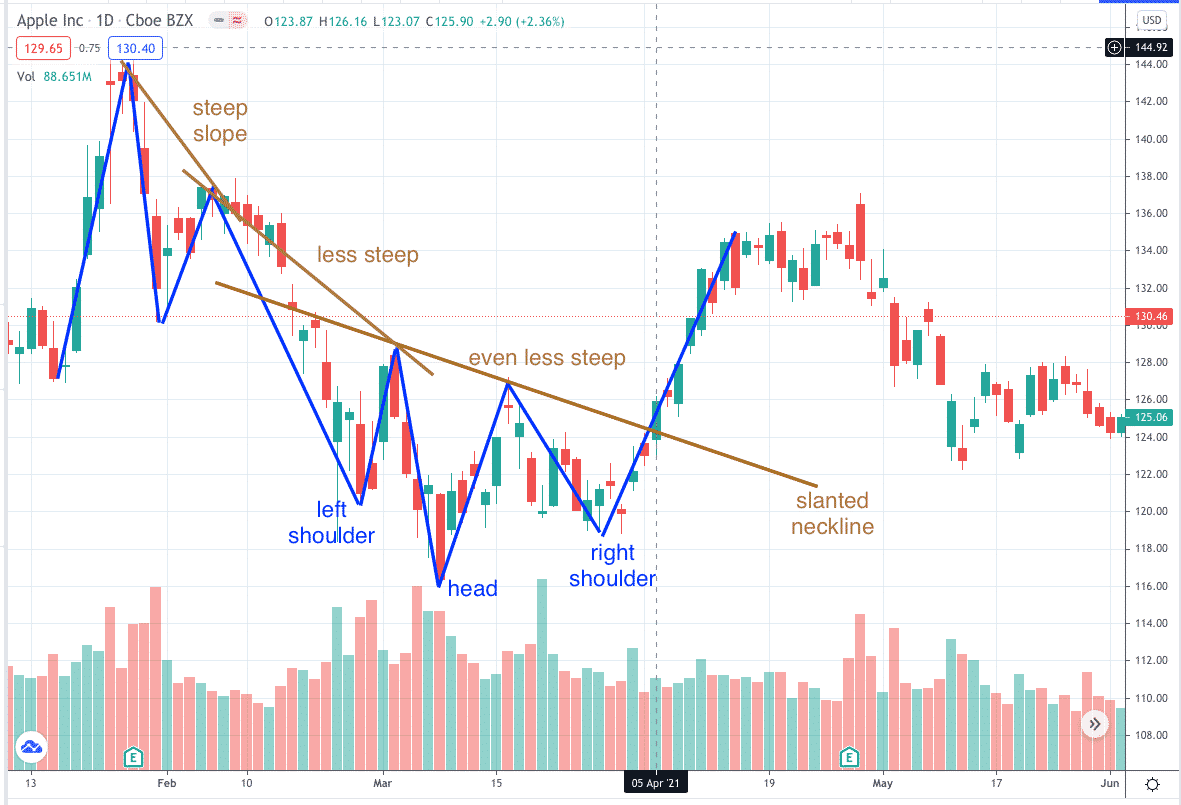

An inverse head and shoulders is an upside down head and shoulders pattern and consists of a low, which makes up the head, and two higher low peaks that make up the left and right shoulders. The right shoulder on these patterns typically is higher than the left, but many times it's equal.